Introduction

The Cross-the-Strait Money Transfer is a featured product of foreign exchange remittance. Hua Xia Bank tailored this product for Taiwan enterprises. It includes two-way money transfer of outward remittance to and inward remittance from Taiwan.

Functions

It accelerates the traditional remittance time from 2~3 banking days to 2 hours. It makes rapid funding of remittance to Taiwan, reduces the fund in transit, and improves the efficiency of customer's funds.

Features

1. Hua Xia Bank has established correspondent relationship with 49 banks in Taiwan and formed correspondent bank network covering the entire Taiwan Island which ensures seamless money transfer across the straight.

2. The customer's fund may be remitted to or from Taiwan banks to ensure the rapid two-way fund transfer needs of the customer.

3. The USD remittance is completed within a maximum of 2 hours in the morning of Beijing Time, which is before the start of value date in the US.

4. It maximizes customer convenience. The fund may be cleared in US dollars in regions with US dollar as the functional currency, or be cleared in US dollar in Hong Kong to ensure the funding before the closing of value date.

How to Apply

1. The customer opens an international settlement account with Hua Xia Bank.

2. The customer presents to Hua Xia Bank the remittance application and other relevant documents before 14:30 pm.

3. The customer supplies to Hua Xia Bank the correct, complete, and standard remittance instructions such as remittee account number, account name, and depository bank name.

Price

1. Foreign exchange remittance collection: Free of charge.

2. Foreign exchange remittance: Remittance service fee (1‰ of the equivalent RMB amount of the foreign exchange remitted, minimum RMB 50 and maximum RMB 1,000) and communication fee (RMB 80 per transaction).

Illustration

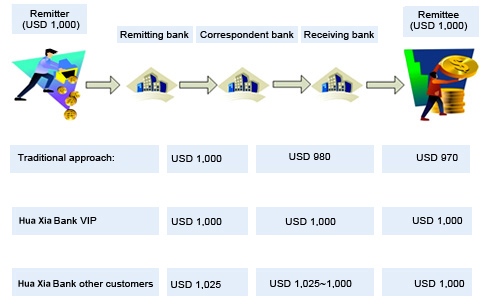

Introduction

The U.S. Dollar/Euro Full No Deduct (FND) refers to the service where Hua Xia Bank ensures full remittance fund collection by the payee with no deduction on the fund. When a customer applies for the USD outward remittance at Hua Xia Bank, Hua Xia Bank locks the intermediary bank's deduction cost to ensure that the amount of outward remittance is consistent with the amount collected by the payee.

Functions

When the company makes overseas outward remittance, and according to the international practice, the company faces increasing remittance cost for increasing number of intermediary banks. This product locks in the costs arising during single international money transfer within USD 25 per USD remittance transaction or 30 per Euro remittance transaction and ensures the un-deducted fund received by the payee. Such costs include the agency clearing fee of the remittance bank and depository bank, the agency clearing fee of the receiving bank, and fund release fee of the receiving bank. It assists the companies to strengthen trade partnership and to reduce the complaints on clearing deductions by some sensitive corporate clients.

Features

1. Ensures that the payee receives the remittance in full amount.

2. Helps companies to strengthen business partnerships.

3. Provides customized zero-fee USD remittance services to strategic and high-end enterprises.

4. Substantially reduces customer complaints on clearing charges.

How to Apply

1. The customer opens an international settlement account with Hua Xia Bank.

2. The customer supplies to Hua Xia Bank the correct, thorough, and standard remittance instructions including the remitter’s account number, account name, and name of depository bank.

3. It is specified that the remittance is paid in full amount with no deductions.

Price

1. Hua Xia Bank VIP Clients: Remittance Service Fee + Postal and Communication Fee, no additional charges.

2. Other Clients: Remittance Service Fee + Postal and Communication Fee + FND Clearing Fee (FND Clearing Fee: Remittance in USD is USD 25 per transaction, or remittance in Euro is 30 per transaction).

Illustration

Introduction

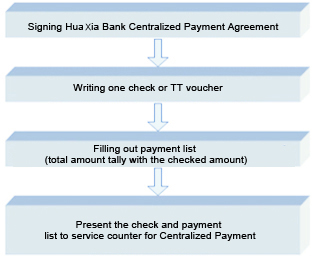

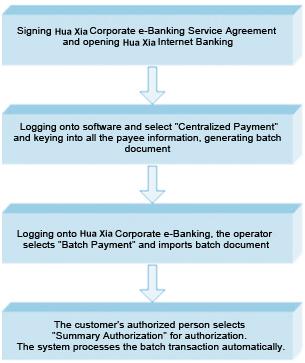

The Centralized Payment Express refers to the cash management service where the payer pays to multiple payees through Hua Xia Bank, either at the counter or via Internet banking, by providing a payment list and relevant payment proofs.

Functions

According to One single check (or T/T receipt) and relevant payment details, Hua Xia Bank should make payments to multiple payees.

Features

1. Improves work efficiency. Accounting staff at companies are freed from tedious procedures of filling out documents and deals with multiple transfers in one transaction, which improves work efficiency of both the company staff and the approval officials.

2. Reduces cost. The customer can apply by one click via the Internet Banking instead of coming to the counter.

How to Apply

Apply at the Counter:

1. The bank and the company sign the Centralized Payment Agreement.

2. On the payment date, the customer writes a check (or T/T receipt) to the bank and provides the relevant payment list. The check amount is the total payment amount and the payment list articulates the payee name, account number, depository bank, amount of payment, and purpose.

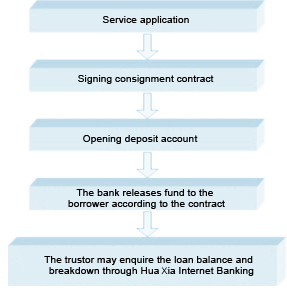

Introduction

The Entrusted Taiwan Loan is an agency loan arrangement where the Taiwan company (trustor) provides fund and Hua Xia Bank (trustee) makes loans according to the trustor's specification of loan target (borrower), purpose, amount, Tenor, and interest rate. Upon receipt of the borrower authorization, Hua Xia Bank can provide the trustor with the timely update of the trusted fund by Internet Banking.

Functions

1. Bridges the gap between cash-rich Taiwan companies and those short of cash.

2. Provides a safe and convenient value added channel for Taiwan companies with idle fund.

3. Provides financing to cash-strapped Taiwan companies that face monologue financing channel and reduces financing cost.

4. The trustor will obtain timely update of balance and detailed information of the trusted loans via Internet Banking.

How to Apply

1. The trustor applies at the bank.

2. The trustor signs agreement with Hua Xia Bank.

3. The trustor opens deposit account at Hua Xia Bank and transfers the trusted fund into the account.

4. Hua Xia Bank examines the agency loan requirements and signs tri-party agency loan agreement with the trustor and the borrower. Hua Xia Bank then transfers the fund from the trustor's account into the trusted deposit account as per the contract.

5. Upon the trusted loan release, the trustor presents to Hua Xia Bank the trusted loan release authorization. Hua Xia Bank releases the fund according to the trustor's authorization and agreement.

6. In case the trustor subscribes for Internet Banking enquiry function, the trustor shall seek permission from the borrower and stipulate the arrangement in other terms and conditions in the trusted loan contract. The borrower also needs to authorize such arrangement in Hua Xia "Entrusted Taiwan Loan – Signed Account Internet Banking Letter of authorization".

7. Upon maturity of the agency loan, Hua Xia Bank assists the loan collection and, according to the trustor's instruction, transfers the fund into the trustor's deposit account or the designated account in Hua Xia Bank.

Copyright Hua Xia Bank, All rights reserved.IPV6 Enable